- Home

- Payment Processing

Credit Card Processing

CardConnect

CardConnect allows you to safely and securely accept online and in-person payments. This setup is ideal for merchants that want to offer their brick and mortar store products to a wider market via e-commerce. When you sign up for CardConnect, you’ll enjoy award-winning credit card payment integration for software, SMBs, enterprise businesses, and more. CardConnect will make it a top priority to give unmatched 24/7 support and resources to businesses so they can keep growing and flourishing.

Their Independent Software Vendor (ISV) program will allow you to create scalable solutions with your payment acceptance that works with your existing software. Every transaction will be processed seamlessly with top-notch security for both you and the customer.

CoPilot and CardPointe help you manage all of your transactions. CoPilot allows you to more efficiently track everything in your portfolio including merchant application processing, risk monitoring, and support tickets. CardPointe allows you to securely integrate, accept, and manage payments with software and hardware.

Electronic Payments

Electronic Payment’s solutions are designed to meet your needs whether you’re small and starting out or a large-sized business. In our current ecosystem, it’s key to have a reliable and affordable POS system. If you have not purchased equipment yet, the team can help design a solution that works for you.

Exactouch is one option from Electronic Payments. It’s a complete POS system with affordable hardware and software. When you need merchant support, they are there to help you. It is perfect for restaurants, retail locations, salons, convenience stores, and more. Exactouch works seamlessly with ApplePay, GooglePay, and NFC to ensure that your clients can pay the way they want to.

Need to take payments on the go? Take advantage of the mobile card reader that works with your smartphone. Take your products to events, vendor fairs, and demos because payments can run just as securely as if you were on location.

Heartland

Heartland makes it as simple as possible to accept all the ways that your customers want to pay and where. Whether they’re at a counter, table, kiosk, food truck, or online, there is a suite of solutions available to you. This includes mobile card readers, laptops, terminals, and online portals. There is even the option to set up recurring payments on a schedule. They make it easier to accept EMV Chip Cards, Digital Wallets, ACH, and Gift Cards. They’re working to remove the distance between you and your customers.

Heartland works to ensure there is seamless compatibility for your mobile store. It works with most e-commerce platforms to ensure people can browse and purchase in minutes. There are agents available 24/7, 365 to ensure your integrations are secure and working perfectly.

Heartland has solutions designed especially for home and professional service businesses. It’ll help ensure that business owners are productive, not busy. Customize your payment portal so that your clients can manage their own subscriptions, select services, and pay on their own.

World Pay

It should be easy to allow your customers to pay in a way that is most convenient for them. WorldPay has a suite of solutions that works with established credit cards and contactless payments. They’re global experts and are on the pulse of the most popular payment methods. You won’t wait days for deposits or new technology, you’ll wait hours.

Security is of utmost importance to them. WorldPay has a team of experts to help you with anything you might need. Their unique systems and terminals have complete protection in data security, fraud protection, PCI compliance, and data breaches. You can focus on selling, not worrying.

WorldPay is designed with scalable solutions. You can benefit from a wide range of features whether your business is small and starting out or you’re a large enterprise. Everyone will be able to offer a better customer experience, unmatched security, the best in support.

Payment Processing

Gift Cards and Loyalty Programs

$0.00

Grow your business with Gift Cards. Gift cards are expected to be a 160 Billion industry by 2018, so what are you waiting for? * 93% of American consumers have given a gift card and customers are known to spend upwards of almost 40% more using them.* As a service provider, we can make gift cards for single locations or custom-designed card...

WorldPay

WorldPay

$0.00

WorldPay Payment Solutions | Consultants In-A-Box Make Payments Seamless, Secure, and Scalable with WorldPay and Smart Automation WorldPay is a full-featured payments platform that brings together in-person, mobile, and online acceptance into a single, global stack. It supports card-present terminals, contactless wallets, eC...

Electronic Payments Inc

Electronic Payments Inc

$0.00

Electronic Payments & Integrated POS Solutions | Consultants In-A-Box Simplify Payments and Drive Business Efficiency with Integrated Electronic Payments Electronic payments are no longer just a way to take money — they are the backbone of modern commerce. Integrated payment solutions combine point-of-sale systems, mobil...

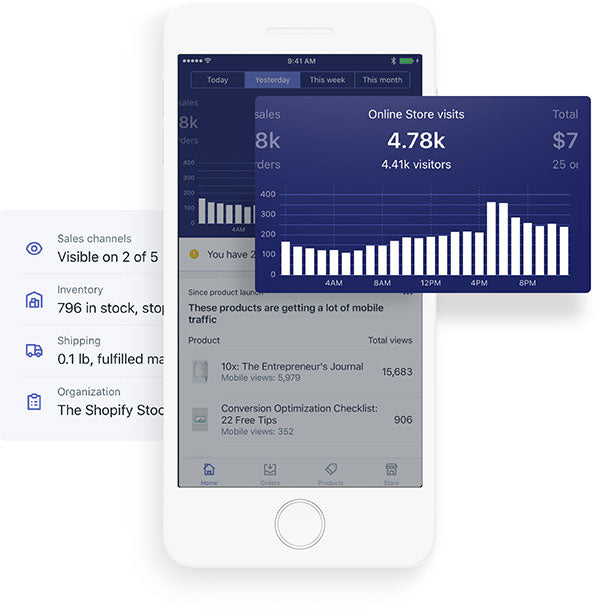

Online Stores

Online Stores

$0.00

Everything you need to start an online store and sell online Selling online with your own ecommerce website has never been easier, faster, or more scalable. Impress your customers with a beautiful store. Drag-and-drop store builder Choose from over 100 professional and free store themes. Customize colours, imagery, and fonts with ease. No design...

Mobile Payment Solutions

Mobile Payment Solutions

$0.00

Use a mobile credit card reader to accept payments on-the-go Take payments anywhere your customers are with an easy-to-use mobile credit card reader that attaches directly to your smartphone or tablet. It’s the perfect add-on to a stationary credit card terminal or point of sale system and it’s a great stand-alone option for certain small bus...

ACH Processing

ACH Processing

$0.00

ACH Processing & eCheck Payments Services ACH Processing & eCheck Payment Solutions At Consultants In-A-Box, we understand the importance of offering versatile payment options to your customers, whether they prefer traditional check payments or modern electronic alternatives. Our sui...

Credit Card Processing

Credit Card Processing

$0.00

PCI Compliance and your Merchant Account We don’t put a price on your customers' card security... Neither should you. PCI Compliance is a standard of security established for any business that processes credit cards. Whether you have a computerized POS system, process over a phone or a credit card terminal, or have an e-commerce website, P...

Point of Sale Systems

Point of Sale Systems

$0.00

User-friendly High-resolution touchscreen, intuitive interface, and pivoting arm make it easy to use with customers Secure Providing the latest in EMV and NFC technology, our solutions are equipped to protect every transaction and includes breach coverage and IP scanning.Practical Eliminate clutter and take back vaulable counterspace! Our soluti...

Collections

- 0CodeKit Integrations

- Accounting

- ACH Processing

- Active Campaign

- Ai Automations and Integrations

- Aircall

- All Integrations

- Annuities

- Applications

- ATS

- Auto & Home

- BI and Analytics

- Brand Management

- Bullhorn Integration Endpoints

- Business Infrastructure

- Business Operations

- Business Retirement Plans

- Business Systems

- Card Access

- CCaaS

- Clio Integrations

- Cloud Services

- Connectivity, MPLS, Private Line

- Cost Reduction

- CPaaS/SIP

- Customer Relationship Management

- Data Center

- Developer Platforms

- Development

- E-Commerce

- E-Commerce Software

- eREIT

- Field Service Automations and Integrations

- Finance Automations and Integrations

- Financial

- Fire Alarm Systems

- Fleet Tracking

- FTP Hosting

- Gift Card & Loyalty

- Google Sheets

- Graphic Design

- Health

- Healthcare Software

- HR and HCM Automations and Integrations

- HR Software

- Human Resources

- Implemenation

- Insurance

- Integrate RingCentral With Monday.com

- Integrations

- International

- Intrusion Systems

- Investments

- Invoicing

- Invoicing and Contract Software

- Lead Generation

- Learning Management

- Legal

- Legal Services

- Long Term Care

- Managed Investments

- Managed Services

- Marketing

- Marketing

- Marketing Automations and Integrations

- Micro Funding

- Mobile Payments

- Mobility/IoT

- Monday.com Integrations

- Mutual Funds

- Other

- Others Software

- Outsourced Sales

- Pay Per Click

- Payment Processing

- Payroll

- Phone Systems

- Photography

- Pre-Paid Legal

- Print & Promotional

- Process Implementation

- Product Management

- Productivity

- Productivity & Efficiency Improvement

- Project Management

- Recuritment

- Recurring Payments

- RingCentral Integrations

- Sales Software

- Sales Training

- SD-WAN

- Search Engine Optimization

- Security

- Security and IT Management

- Security Systems

- Sling Scheduling Features

- SMS Communication

- Social Media

- Social Media Management

- Telecommunications Automations and Integrations

- Term Life

- Top Products

- Twilio Integrations

- UCaaS

- Video Conferencing

- Video Production

- Video Surveillance

- Web Development

- Web Hosting

- Webinar & Screen Sharing

- Workflow Training

- Zoho

- Zoho CRM Integrations

- Zoho Email & Collaboration

- Zoho Finance

- Zoho HR

- Zoho Legal

- Zoho Marketing

- Zoho Sales

- Zoho Service

- Zoho Suites